The California Air Resources Board (CARB) held a workshop on the potential amendments to the California’s Cap-and-Invest regulations to incorporate elements of the extension bills, and the continuation of the Program Review process.

Major updates were provided in the slides released before the workshop. This update will provide a summary of the major proposed changes.

Highlights:

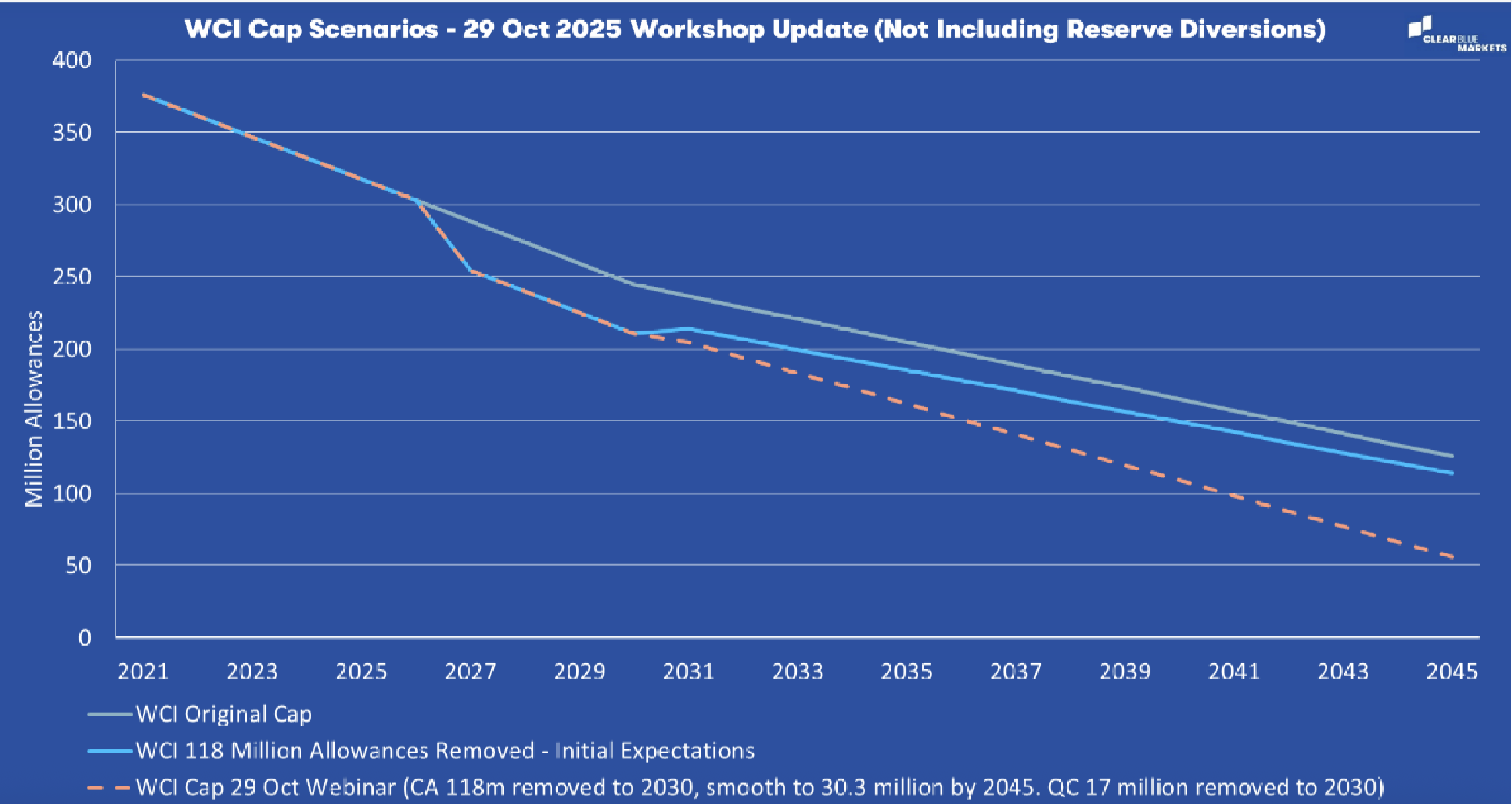

- CARB staff proposal indicates 118.3 million allowances removal between 2027 to 2030 – aligned with accounting for the historical GHG inventory adjustment. The 2045 cap endpoint is at 30.3 Million Allowances.

- Comments are requested on the legislative direction to subtract offsets usage from future allowance budgets. This is the biggest open question from the Workshop and prompted questions from stakeholders.

- The slide presentation confirms that historically, allowances have already been transferred to the APCR to account for offsets “under the cap.” Future allowance removal for offset usage could potentially be smoothed out given the triennial surrender pattern.

- To prevent leakage, CARB is considering maintaining higher free allocations despite the stricter cap.

- CARB is targeting the release of the ISOR towards the end of 2025, with a vote to adopt the rulemaking by April 2026 and implementation by September 2026.

The workshop presentation can be found here.

Changes to Allowance Budgets

CARB has provided updated considerations on its future allowance budgets and cap trajectory. Most of these updates were within our expectations.

Even though the final rulemaking is expected to have an effective date in 2026, CARB will implement changes to the allowance budget from 2027 onwards, due to the timeline required to finish the current rulemaking and the deadline for 2027 free allowance allocations.. CARB has also proposed removing 118 million allowances from the 2027 through 2030 budgets instead of the 180 million allowances that would be removed according to the previously presented Option 1 cap. Removal of 180 million accounts for the updated GHG inventory and is aligned with the statutory SB 32 target for a 40% reduction vs. 1990 emissions by 2030.. The reasoning for this is to minimize compliance disruption and potential impacts on consumer affordability. These adjustments are in line with our expectations and have been incorporated into our modeling.

For post-2030 caps, CARB is proposing a 2045 cap endpoint of 30.3 million allowances, with a smooth decline between the 2030 and 2045 caps. Furthermore, CARB has indicated that they will not be removing allowances from the APCR or Price Ceiling account, They will, however, make a further diversion of post-2030 budgets into the APCR Tier 1 reserve to bolster cost-containment.

The figure below shows a potential cap trajectory consistent with today’s workshop compared to previous expectations.

Allowance Removal for Offset Use

The passage of AB 1207 with language requiring, “A number of allowances equal to the total number of offset credits used for compliance obligations in the prior year shall be removed from the next year’s annual allowance budget and retired,” is a significant program design element requiring regulatory interpretation. Although there were a number of stakeholder questions, the workshop did not provide a definite conclusion as to how CARB will incorporate this requirement, and how it will interact with CARB’s “historic approach” from prior rulemakings where allowances were transferred to the APCR to account for offset use assuming offset usage was maximized.

The workshop did point out, as ClearBlue also did, that direct implementation of AB 1207 will result in significant variability of allowance supply every three years, as offset submissions for compliance peak every three years at the time of the triennial surrenders. We expect that CARB will ultimately look to employ a methodology to smooth the effect of allowance retirements for offsets usage.

Currently, CARB is soliciting public comments on the best methodology to employ for allowance removal for offset use:

- Does the predictable variability in allowances available for auction under this provision pose concerns?

- Are there alternative implementation suggestions for this provision that minimize predictable variability for auctions

One point that was not discussed in the workshop presentation was how CARB will address the offset usage between 2026 up to 2030. CARB has already estimated offset usage during this period to be around 68 million and has already deposited into the APCR around 22 million allowances to account for the offset use.

It is unclear at this point if CARB will further remove allowances to account for offset use up to 2030. If so, this may result in allowance removals through 2030, beyond the 118 million proposed removal. CARB could also adjust allowance supply to the extent actual offsets usage deviates from what was deposited in the APCR in prior rulemakings to account for offsets under the cap.

No-Cost Allowance Allocation

The presentation then addressed no-cost allowance allocations to industrial entities, electricity utilities, and natural gas utilities.

CARB is soliciting comments to keep free allocations to industrial entities at an elevated rate, despite the proposed reduction in future caps. This approach is consistent with the legislature and Governor's focus on affordability during the extension negotiations.

CARB is also soliciting comments on how to incorporate AB 1207 requirements on diverting no-cost allowances from natural gas utilities to electricity utilities. CARB is considering when this transition should start, the amount to be transferred, and other considerations.

Timeline

CARB has provided a tentative schedule for the completion of the program amendments:

- April 2026: CARB Board consideration of proposed amendments

- 1 September 2026: Amended Regulation in effect for vintage 2027 allowance allocation.

Preliminary Outlook

Our initial impression of the workshop contents is directionally bullish, primarily because of the aggressive timeline and confirmation of removal of allowances from supply to 2030.

ClearBlue shared this information in a Live Update with clients earlier this week, providing additional context using our proprietary modelling scenarios to forecast implications on removals and pricing into 2030 and beyond.

For information about our Market Intelligence services, please contact us today.