China’s national carbon market, the world’s largest, has quietly initiated a major reset at the start of 2026. This strategic move is primarily aimed at tackling the allowance surplus that has weighed on the market, signalling a new, tighter operational dynamic for the year ahead.

Key Market Changes and New Rules

The "RESET button" introduces critical changes through new allowance carryover and compliance rules:

- Allowance Conversion Mandate: Covered enterprises are now required to convert their existing, old vintages of allowances (CEA vintages from 2019-2024) into the new CEA-2025 vintage. Crucially, old vintages cannot be utilized for 2025 compliance later in the year 2026.

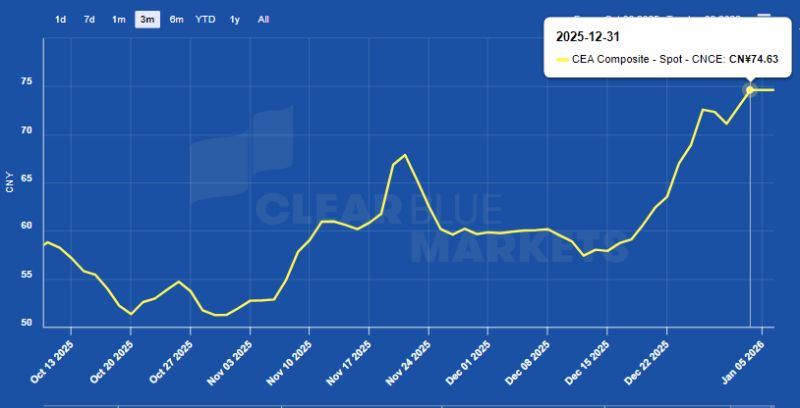

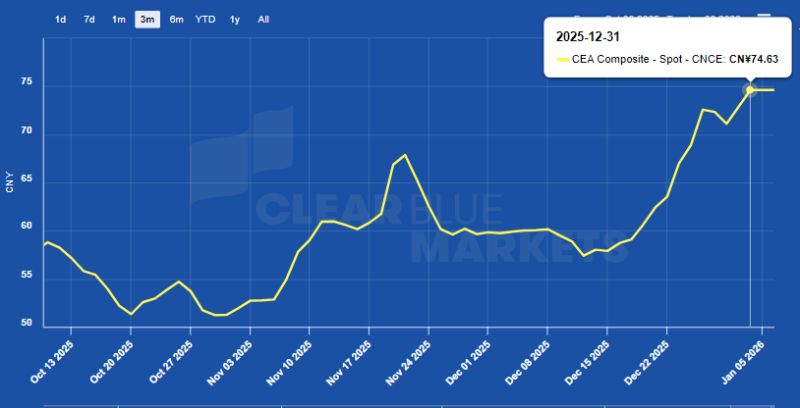

- New Price Mechanics: As of January 5th, the official "composite price" for the market is solely tracking the CEA-2025 vintage. While older vintages are still tradable, they no longer have any influence on the composite index, as their weighting has been set to zero.

Current Market Status (As of Early January)

The market is currently in a transitional state as it awaits the official launch of the new vintage:

- CEA-2025 Issuance: No CEA-2025 allowances have been issued or converted at this time.

- Trading Activity: There have been zero trades recorded so far in the new vintage.

- Price Anchor: The price remains anchored at the previous closing rate of CNY 74.63 (from December 31, 2025).

What’s Next: Market Tightening and Price Discovery

Regulators began processing carryover requests on January 5th. The new vintage is expected to enter the market imminently, which will likely create a new price discovery dynamic.

The market expansion is also notable, with the system now covering 8 billion tonnes from the power sector, as well as 3 sectors under the Carbon Border Adjustment Mechanism (CBAM).

Supply Overhang and Outlook

The new conversion rules are set to significantly curb the supply overhang:

- Surplus Estimate: The estimated surplus of old CEAs (2019-2024 vintages) is around 400 million.

- Conversion Estimate: Based on calculations using trading volumes, it is estimated that approximately 200 million CEAs will be converted to the new 2025 vintage.

- Market Outlook: This reduction in supply overhang is anticipated to tighten the market outlook, which is expected to support and drive the CEA price upward throughout 2026.

Contact us to discuss the comprehensive China carbon market Market Intelligence and price forecast available to subscribers of the ClearBlue Markets Vantage platform

Notices on CEA 2025 launch and conversion rules:

https://www.cets.org.cn/tzgg/7246.jhtml

https://www.cets.org.cn/tzgg/7253.jhtml